Review the ERA – Electronic Remittance Advice – ERA Tab article for more detailed information.

When processing an ERA file, the system will attempt to match the payer’s Tax ID to an insurance company’s Tax ID.

Locations of Payer Tax ID in Valant

Navigate to Persons & Institutions | Insurance Companies

Select an insurance company – Tax ID (TIN) is located on lower left of below image. Click New Tax ID to add one or more, click Delete to remove a Tax ID from the list.

Multiple TINs can be added for each payer to increase the accuracy in identifying the payer to associate with the payment, without needing to regularly update or remove the TIN to get new ERAs to be associated with the correct payer.

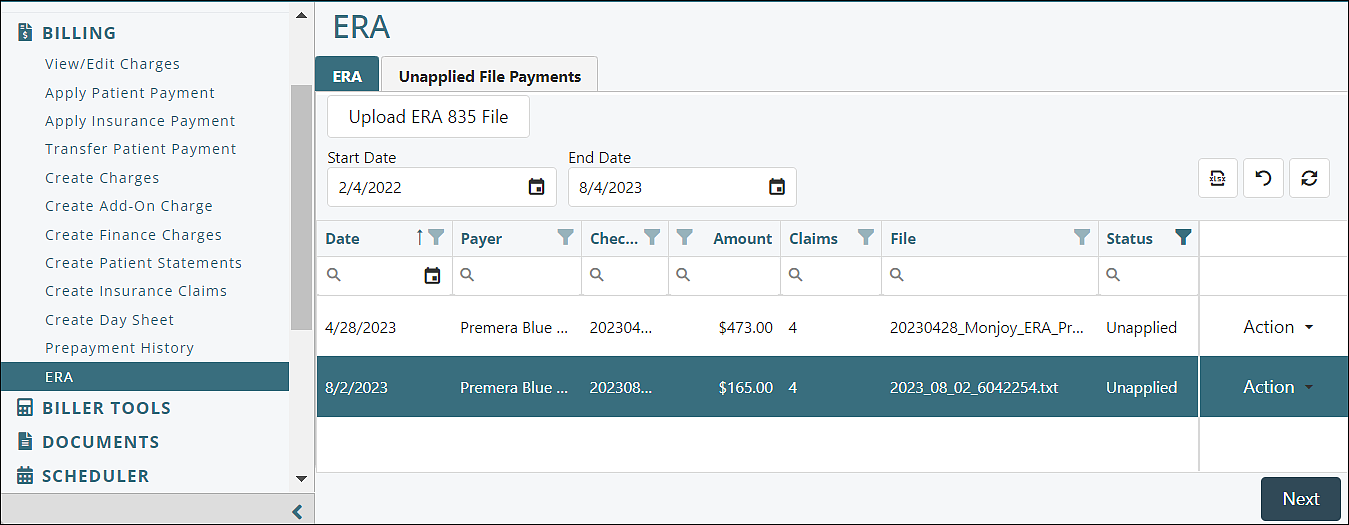

Navigate to Billing | ERA. Select an ERA and click Next

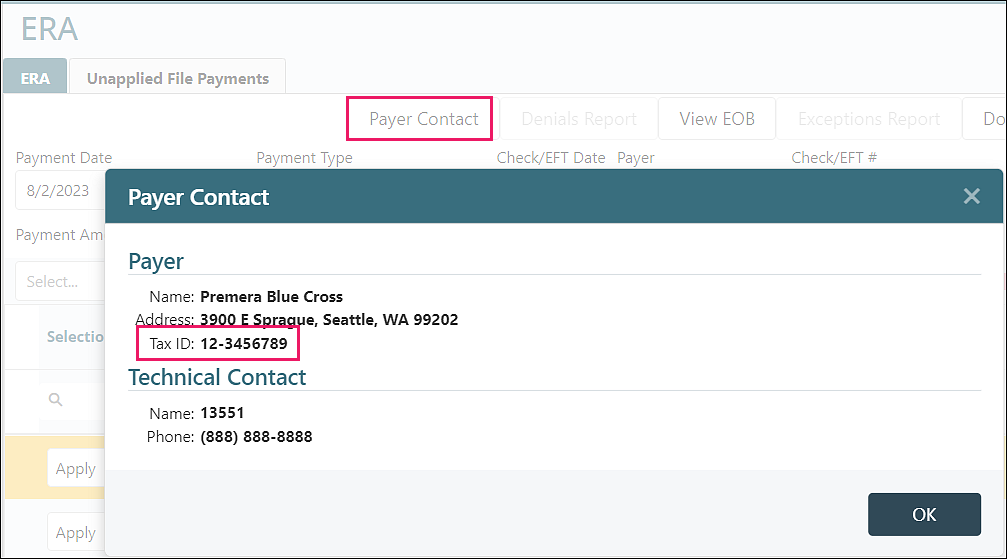

The payer Tax ID can be viewed in the Payer Contact window in Billing | ERA | ERA tab

Match Payer by Tax ID: Payer Tax ID matches an Insurance Tax ID

When the payer’s Tax ID matches with an insurance company, clicking Next at the bottom right of the screen will produce the ERA posting screen.

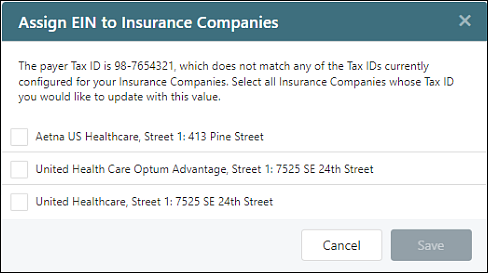

Match Payer by Tax ID: No Tax ID Match

If none of the insurance companies match the Tax ID of the payer in the ERA file, then the user will be prompted to select an insurance company for this ERA file after clicking Next. The Assign EIN to Insurance Companies window opens. EIN = Employee Identification Number – can be Tax ID or SSN

Select the box to the left of one or more insurance companies and select save. This automatically places the payer’s Tax ID in the insurance company’s Tax ID field and returns to the ERA list. Select the ERA and then click Next to continue processing the ERA.

Note: Only insurance companies with a blank Tax ID will show in the list. If an insurance company’s Tax ID needs to be changed to post the payment, you can copy the Tax ID and paste it into the appropriate insurance company’s Tax ID field.

Match Payer by Tax ID: Multiple Tax ID Match

If the Tax ID associated with the payer of the ERA file matches to more than one insurance company in the list, then the system will automatically select an insurance company to be used.

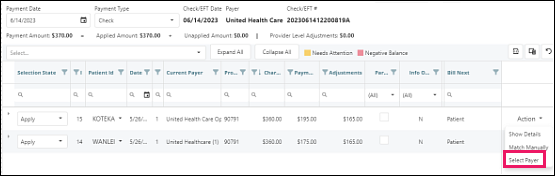

The user has the option to change that payer by clicking Action | Select Payer for each line in the ERA window.

When processing the ERA file, the user will be allowed to change the insurance company.

Note: The Select Payer option is only available when more than one insurance company exists with the same Tax ID

Match Payer Manually

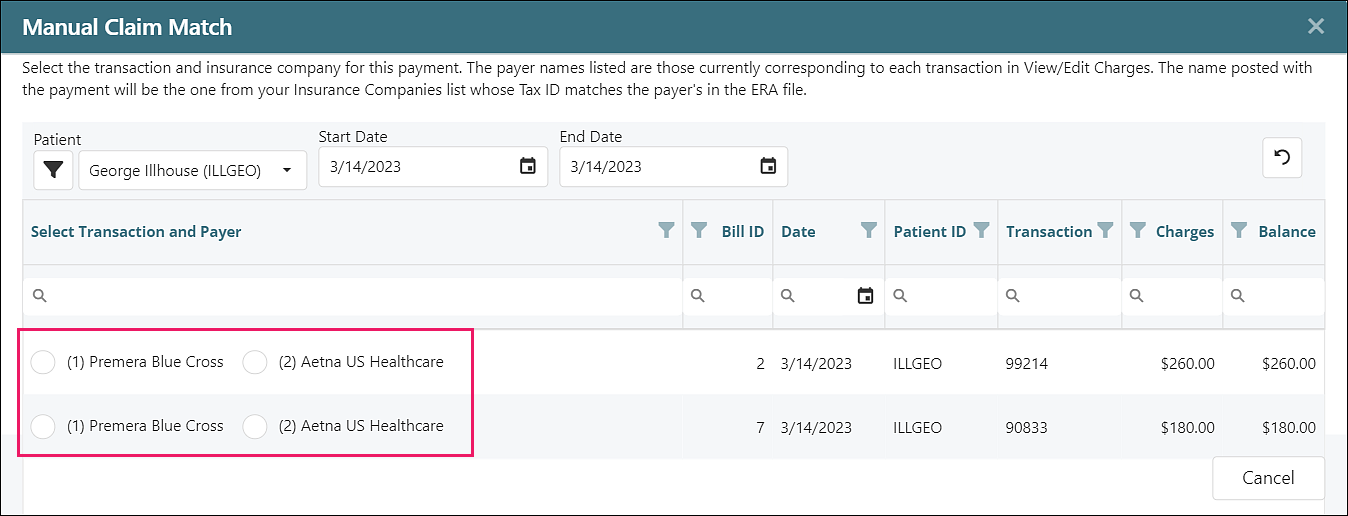

This feature allows a user to manually assign the payer to the payment is being applied.

This is useful when the insurance companies associated with a given service line has changed since the claim was originally billed and the user wants to ensure that the payment is applied to the correct payer.

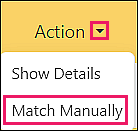

To change the payer associated with a given payment, select Action | Match Manually

The Manual Claim Match window will open.

If there are multiple payers, selecting the appropriate payer will change the insurance on the posting screen.

Note: Regardless of the insurance company listed, the payment associated with the ERA file will be from the insurance company with the same Tax ID as that of the payer in the ERA file.

See ERA – Electronic Remittance Advice – ERA Tab article for more details

Review Video Tutorial - Billing: Electronic Remittance Advice (ERA) article